Ventech China Insights | Haidilao Vs. McDonald's, to survive the pandemic

The outbreak of Coronavirus has a huge impact on various industries, and the catering industry is the first to bear the brunt. Dimdude(点都德), a Guangzhou-branded dim-sum restaurant that once had a long queue of diners, had to close 5 directly-operated stores (48 total stores) to stop losses in time; in early February, the Japanese chain of Watami ,which had been operated in China for 15 years, closed all stores and quit Chinese market.

According to the "Research Report on the Impact of the Corona Virus on the Finance and Operation of the Chinese Catering Industry" jointly released by Deloitte and the Chinese Cooking Association, 80% of the catering companies interviewed expect that additional financing will be required in the next 6 months to deal with restaurant employees' wage costs and cash flow pressure in various aspects such as cash return and renting costs.

Store pictures of Dimdoude in Guangzhou(点都德) and Watami in Hong Kong

In early April, various restaurants gradually resumed dine-in business. At this time, giant restaurants like Haidilao and Xibei were reported with a price increasing comparing to that set before the epidemic: the price of a plate of crispy meat increased by nearly 60% compared with the price set in July 2019. After consumers showed a rage about this phenomenon, restaurants quickly issued a letter of apology and reduced prices.

Whether it's a measure of marketing promotion or a desperate move, it reveals an identical fact: the huge operating costs of the catering companies are insufficient for cash flow reserves. According to Liu Long, the founder of Dalongyan hotpot(大龙焱), “Most of Chinese catering companies are based on inertial thinking to reserve cash flow. Due to the sudden outbreak of the outbreak, there is no sign before and most companies will not reserve sufficient cash flow. "

According to the data from the catering service provider Hualala, as of April this year, the overall loss of the Chinese catering market during the epidemic has reached RMB 565.495 billion, equivalent to Haidilao ’s 30-year operating income. Increasing prices seems to be the only way for some companies to save themselves. However, this simple and crude move on the other hand leads to the loss of customers, which seems to be an ineffective way of self-saving. At the same time, we also see that the innovative methods that other catering stores applied are worth learning from. For example, a chain brand of Hotpot stores Xiabu Xiabu (呷哺呷哺)actively explored online retail channels: directing employees to do e-commerce through Wechat, selling inventories, and opening e-commerce platforms and community partners in two weeks.

More importantly, Xiabu Xiabu paid great attention on cash flow control: The bank deposits and financial management tools were unfrozen before the Spring Festival. At the same time, they applied a credit line to reserve cash flow from banks in advance to prepare for the fight with Corona Virus.

This time, we will analyze two leading restaurant companies operated under different business models, Haidilao and McDonald's, to see their remarkable anti-risk capabilities and self-help methods before and during the epidemic.

Haidilao: Excessive labor costs and cash flow pressure from new store expansion

On January 26, 2020, Haidilao announced the closure of all over 500 stores in mainland China to cooperate with the prevention and control of the epidemic. Although food and beverage companies can subsidize their income through takeout during the store closure, according to Haidilao ’s financial report, the revenue from the takeout business in 2017-2019 only accounted for 1.8% of Haidilao ’s total revenue, even if Haidilao carried out delivery services to save the business, the help that can be brought during the epidemic is actually very limited.

The problem exposed by Haidilao is the expansion of the direct operating stores requires a high capital demanding, revealed by the rent, labor, and raw material costs and the capital expenditure on new stores on the other hand.

From the cost side, the cost of raw materials can be neglected since the store closed on January 26. Rental costs have been eased: According to Soochow Securities ’cost estimates for Haidilao, 20% -30% of Haidilao ’s mainland stores during the outbreak received a rent-free period ranging from 15 to 30 days, reducing the pressure on rental costs. However, the estimated rigid rental expenditure per month is RMB 160 million. Human cost is the biggest pressure to Haidilao: Haidilao is well-known for a nice treatment to employees in the industry. The annual cost expenditure on employees accounts for 30% of income (more than 5% of its peers XiabuXiabu). Labor cost expenditure during 2017-2019 was RMB 5.376 billion per year on average. Therefore, it is estimated that the monthly rigid expenditure will be RMB 450 million during the epidemic. Adding with the procurement of necessary material reserves for virus prevention, it is estimated that if the income of Haidilao is completely cut during the epidemic, the rigid expenditure will be RMB 650 million per month.

The financial report shows that Haidilao's book cash and cash equivalents in December 2019 were 2.2 billion yuan. After ignoring the rough estimates of income and expenses generated from January 2020 operating activities, Haidilao's cash reserves can support no more than 4 months. Rigid expenditure.

Picture showing the overseas store of Haidilao

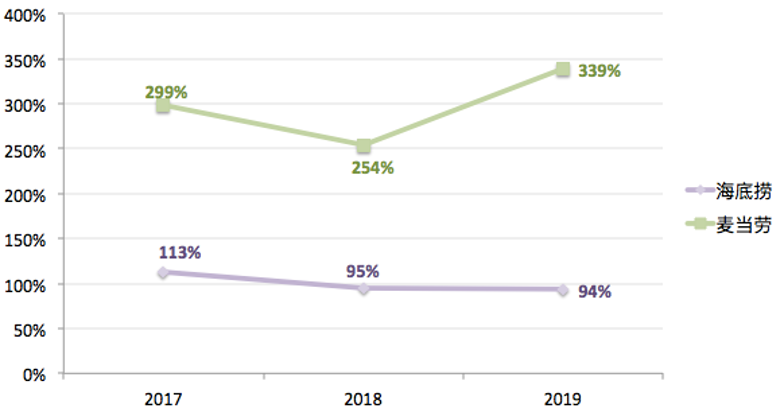

The pressure on the other side of Haidilao comes from capital expenditures caused by expansion. The following figure shows that the investment ratio of Haidilao's new store expansion from 2017 to 2019 is greater than that of McDonald's, applying a franchise mode. The ratio of Haidilao's operating cash flow to capital expenditure is 101%, compared to McDonald's 298%, Haidilao shows a aggressive strategy on store expansion.

Haidilao opened a total of 308 new stores in 2019, with a capital expenditure of RMB 4.88 billion, and an average investment of about RMB 15 million per store. According to data released by Soochow Securities, Haidilao has signed 303 companies in 2020. Assuming no adjustments to the store-opening plan, Haidilao will spend an average of RMB 379 million per month on new stores. Adding the above property, plant and equipment expenditures, Haidilao's cash reserves can only support 2 months of expenses.

Comparison between Haidilao and McDonald's new store expansion: operating cash flow / capital expenditure

Banks has brought an inflection point for the catering industry. Even the leading enterprises in the catering industry faced the problem of insufficient cash flow reserves under the attack of Corona Virus. No wonder Xibei(西贝) will send out a call for help, saying the cash flow is insufficient to support 3 months. However, in a special period, China CITIC Bank and Baixin Bank completed the credit approval in three days, providing a total credit line of RMB 2.1 billion for Haidilao. This undoubtedly solved the urgent needs. After March, the stores began to re-open stepwisely.

Although it will still take some time to restore the pre-epidemic attendance rate and the turnover rate, following measures taken by Haidilao will for sure subsidize the cash flow to a certain level: with the returning of employees, the capacity of the Shuhai supply chain factory gradually resuming, cooperating with Haidilao to enter the fresh direct distribution market, an increasing in the proportion of delivery services and the digestion of a large number of stocking inventories during the Spring Festival through live streaming on big platforms etc. We believe Haidilao can safely survive the post-epidemic stage.

McDonald's: Reasonable utilization of external funds when relieved from debt crisis

Different from Haidilao, McDonald's adopts a franchise-joining mode, relatively light in operation comparing to Haidilao. Franchise stores account for 95% of the total stores, and more than 70% of the operating profit comes from franchise fees and rental income. And this part of the income is due to McDonald's high-quality real estate accumulated through high leverage strategy adopting in early stage, and later converted these real estates into a franchise mode through selling.

The Corona Virus broke out early in the year, and gradually swept the world in March. McDonald's suspended the operations of all stores in France, Spain, Italy, and 90% of the stores in the United States were changed to driving-through and take-out services. In order to help franchisees overcome difficulties, McDonald's delayed the rent collection from March to May, and also helped franchisees apply for the Paycheck Protection Program loan from the government.

In terms of rigid expenditure, thanks to the franchise-joining strategy, McDonald ’s will not face huge monthly employee cost expenditures like Haidilao, but franchise store rentals account for a large proportion of revenue, adding with McDonald ’s high debt ratio, they also face a risk of insufficient cash flow reserves. But in response to the crisis, McDonald's methodically carried out self-saving measures.

McDonald's take-way service has partnered with Uber Eats and Doordash to provide free-delivery for orders over $ 15, from March 24 to April 6, 2020

Rapid reserve of financing cash flow: After the outbreak of Corona Virus, McDonald's started issuing bonds in February and issued a total of USD 6.5 billion by March. At the same time, the bank also issued a credit line of USD 3.5 billion to McDonald's, with a total financing cash flow reserve of more than USD 10 billion. In 2017-2019, McDonald's spent an average USD 4.96 billion in stock repurchase annually, and USD 3.33 billion in dividends to shareholders. After the outbreak, McDonald's suspended the stock repurchase plan, while considering the suspension of the Q2 and Q3 quarterly dividends to maintain financing cash flow.

According to Huachuang Securities, McDonald's short-term debt cost is about 2.2-2.5%. Due to the low bank interest rate and strict control of financing within the company, McDonald ’s has long been financing by issuing corporate bonds and bank loans. The average debt ratio in 2017-2019 reached 115%. The funds are used to support stock repurchasing and dividend distribution. Therefore, the rapid reserve of company's financing cash flow during the epidemic period and the issuance bonds worthy USD 6.5 billion while the credit-standing remained unchanged actually benefited from McDonald's long-term and healthy cooperation between banks.

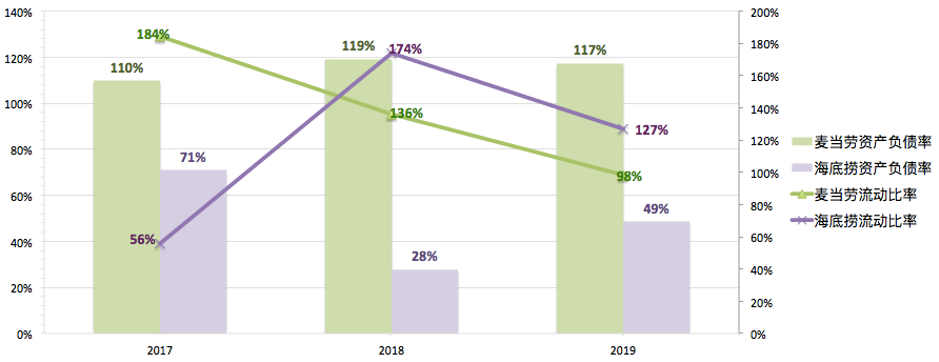

From the perspective of solvency, the average current ratio of Haidilao is about 150% after listing in 2017, and McDonald's average current ratio in 2018-2019 is 117%, which is comparable to McDonald’s, indicating these two companies both have the capability to pay off current debts under crisis.

Debt ratio and current ratio of McDonald's and Haidilao (current assets / current liabilities)

However, under the situation that both of the companies are relieved from debt crisis, Haidilao's liability/asset ratio (average 38% in 2018-2019) is much lower than McDonald's (average 118% in 2018-2019), part of which is due to McDonald's stock repurchasing plan needs the support of bank loans. Another part of the reason is that Haidilao's ability to use external funds is relatively weak. If reasonable financing or borrowing from banks can be made every year without affecting the solvency, this appropriate reservation of cash flow can reduce risks, and at the same time maintain a good cooperative relationship with banks for enterprises. After the outbreak of the epidemic and before the emergency rescue measured by the government and banks, these cash flows reserved in advance may bring a certain buffer period for more small and medium-sized catering companies.

If chain catering companies adopted a reasonable expansion plan, and financed in advance before the Spring Festival and other major holidays to prevent the crisis of cash flow disruption might be caused by salary distribution, shareholder dividends, and large amounts of stocking before the New Year Festival, Dimdudou(点都德) wouldn’t have been forced close 10% of the stores in such a rush under the unpredictable out-breaking of Corona Virus.

For tips for bank loan application, please refer to previews article published on Ventech China’s Wechat public account.